The Most Important Elements of Short-Term Financial Management

205

Mon, Aug 19

Finances

In any corporate structure, there are two types of financial management: short-term and long-term. These two crucial elements of corporate financial management are important to understand and require planning. Short-term and long-term goals can either stand alone or work together, and it’s vital to properly oversee these two aspects as you build on your business.

Short-term and long-term financial management both work to meet your budgeting and investing goals as a business. The short-term, especially, focuses on these components. However, with the proper planning and handling, financial management can help to combat potential issues and deficits, setting your business up for success even in times of struggle and over the long term.

So what are the differences between these two types of financial planning, and how can you better work on your short-term management of finances? First, look at how you can manage your business with its short-term and long-term goals and the crucial elements of short-term financial management.

What is Short-Term Financial Management?

Short-term financial management, simply put, is anything less than a year out. Though some long-term finances may be part of the short-term equation (such as office mortgage loan payments and long-term business costs), this type of financial management usually stays under the year mark. Where these factors into your business are the more immediate future or outcomes with sooner deadlines.

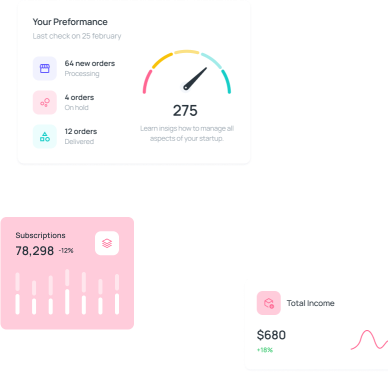

Short-term financial planning deals primarily with balancing short-term income and expenses, including cash, accounts payable and receivable, and inventory. With businesses, short-term financial management may require making budgets per department to better detail transitory costs, like marketing, over-time fees, and one-off expenses.

Loans are another potential short-term finance consideration, especially when evaluating personal loans rates, since promotional interest rates can end after a certain period and cause increased payments. Daily costs and revolving debts can be in a business owner’s short-term financial management, since these things can change weekly or monthly.

Anything that requires immediate attention, whether due to certain deadlines or rates, can be added to short-term financial management. If the consideration goes beyond a year or has more wiggle room, it may serve better under the long-term umbrella.

Əlaqəli Yazılar

Keeping Track of Business Expenses: Your Ultimate Guide

Keeping tabs on your business expenses doesn’t have to be a full-time job (or a mystery). Here’s your no-non...

How to Email an Invoice to Clients Professionally (and Get Paid Faster)

Sending an invoice by email isn’t just about attaching a PDF—it’s about writing a clear, professional mess...

Top 8 Financial Management Tools for Small Businesses

If you run a small business, you must know how tough managing finances can be. Between balancing budgets, chasin...

15 Key Steps for Effective Portfolio Management in 2025

Effective portfolio management can feel like solving a complex puzzle. Pieces need to fit together, but first, y...

A Comprehensive Guide to 3-Way Matching

Strong internal control is a crucial aspect that businesses need to pay more attention to in light of recent and...

Top Invoicing Mistakes Small Businesses Make and How to Avoid Them

Every business—be it a fresh startup or a long-standing company—needs an invoicing process that works. If ca...